Estimated Taxes

The federal income tax is a pay-as-you-go tax. You must pay the tax as you earn or receive income during the year. There are two ways to pay as you go, either by employer withholding or estimated tax payments.

Employer Withholding

If you are an employee, your employer generally withholds income tax from your pay. In addition, tax may be withheld from certain other income such as IRAs, pensions, bonuses, commissions, and gambling winnings. If all of your income will be subject to income tax withholding, you probably do not need to pay the estimated tax. Events during the year may change your marital status or exemptions, adjustments, deductions, or credits you expect to claim on your tax return. When this happens, you should complete a new Form W-4, Employee’s Withholding Allowance Certificate, so that the appropriate amount of tax is withheld.

Estimated Tax

Estimated tax is the method used to pay tax on income that is not subject to withholding. This includes income from self-employment, interest, dividends, alimony, rents, gains from the sale of assets, prizes, and awards. You also may have to pay an estimated tax if the amount of income tax being withheld from your salary, pension, or other income is not enough.

Estimated tax is used to pay not only income tax but self-employment tax and alternative minimum tax as well. If you do not pay enough by the due date of each quarterly payment period you may be charged a penalty even if you are due a refund when you file your tax return.

Who Must Pay Estimated Tax

If you are filing as a sole proprietor, partner, S corporation shareholder, and/or a self-employed individual, you generally have to make estimated tax payments if you expect to owe tax of $1,000 or more when you file your return.

If you owed additional tax for the prior year (did not have enough withheld by an employer), you may have to pay the estimated tax for the current year.

- General Rule

In most cases, you must pay the estimated tax for the current year if both of the following apply.

- You expect to owe at least $1,000 in tax for the current year, after subtracting withholding and refundable credits, and

- You expect your withholding and refundable credits to be less than the smaller of:

- 90% of the tax to be shown on your current year tax return, or

- 100% of the tax shown on your previous year’s tax return, if your previous year’s return covered all 12 months.

Note: The percentage amounts may be different if you are a farmer, fisherman, or your income is more than $150,000 ($75,000 if Married Filing Separately).

Who Does Not Have to Pay Estimated Tax

If you receive salaries and wages, you can avoid having to pay an estimated tax by asking your employer to withhold more tax from your earnings. To do this, file a new Form W-4 with your employer. There is a special line on Form W-4 for you to enter the additional amount you want your employer to withhold.

You do not have to pay the estimated tax for the current year if you meet all three of the following conditions:

- You had no tax liability for the prior year

- You were a U.S. citizen or resident for the whole year, and

- Your prior tax year covered a 12 month period.

You had no tax liability for the prior year if your total tax was zero or you did not have to file an income tax return.

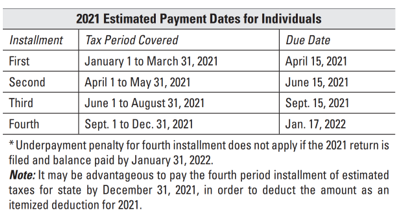

When To Pay Estimated Taxes

For estimated tax purposes, the year is divided into four payment periods. Each period has a specific payment due date. If you do not pay enough tax by the due date of each of the payment periods, you may be charged a penalty even if you are due a refund when you file your income tax return.

You can use Form 1040-ES, Estimated Tax for Individuals, to file your quarterly estimated tax payments. Or, you can make all of your federal tax payments including federal tax deposits, installment agreements, and estimated tax payments using the Electronic Federal Tax Payment System (EFTPS). If it is easier to pay your estimated taxes weekly, bi-weekly, monthly, etc. you can, as long as you have paid enough in by the end of the quarter. Using EFTPS, you can access a history of your payments, so you know how much and when you made your estimated tax payments. See www.eftps.gov/eftps, for more information.

Underpayment of Estimated Tax

If you did not pay enough tax throughout the year, either through withholding or by making estimated tax payments, you may have to pay a penalty for underpayment of estimated tax. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.

The penalty may also be waived if:

- The failure to make estimated payments was caused by a casualty, disaster, or other unusual circumstance and it would be inequitable to impose the penalty, or

- You retired (after reaching age 62) or became disabled during the tax year for which estimated payments were required to be made or in the preceding tax year, and the underpayment was due to reasonable cause and not willful neglect.

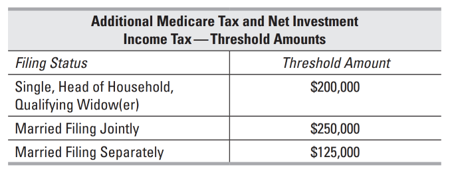

Additional Medicare Tax

A 0.9% Additional Medicare Tax applies to Medicare wages, Railroad Retirement Tax Act compensation, and self-employment income over the threshold amount based on your filing status. You may need to include this amount when figuring your estimated tax.

Net Investment Income Tax

You may be subject to the Net Investment Income Tax (NIIT). NIIT is a 3.8% tax on the lesser of net investment income or the excess of your modified adjusted gross income (MAGI) over the threshold amount for your filing status. NIIT may need to be included when figuring your estimated tax.

Contact Us

There are many events that occur during the year that can affect your tax situation. Preparation of your tax return involves summarizing transactions and events that occurred during the prior year. In most situations, treatment is firmly established at the time the transaction occurs. However, negative tax effects can be avoided by proper planning. Please contact us in advance if you have questions about the tax effects of a transaction or event, including the following:

- Pension or IRA distributions

- A significant change in income or deductions

- Job change

- Marriage

- Attainment of age 59½ or 72

- Sale or purchase of a business

- Sale or purchase of a residence or other real estate

- Retirement

- Notice from IRS or other revenue departments

- Divorce or separation

- Self-employment

- Charitable contributions of property in excess of $5,000